How to access the Coronavirus Statutory Sick Pay Rebate Scheme

Posted: Wed 23rd Feb 2022

Due to the spread of the Omicron variant, the government has reopened its scheme for employers to get rebates on coronavirus-related statutory sick pay (SSP).

This article is a summary of the official government guidance. We recommend reading the full guidance before submitting a claim.

UPDATE: The government has announced the Coronavirus Statutory Sick Pay Rebate Scheme will close on 17 March 2022. Employers have until 24 March 2022 to submit any new claims for absence periods up to 17 March 2022, or to amend claims that have already been submitted.

From 25 March, pre-pandemic statutory sick pay (SSP) rules will return. This means employers can revert to paying SSP from the fourth qualifying day their employee is off work regardless of the reason for their sickness absence. However, no rebates will be provided.

Who can use the Coronavirus Statutory Sick Pay Rebate Scheme

UK employers are eligible for the scheme if:

you have already paid an employee’s sick pay (use the SSP calculator to work out how much to pay).

you are claiming for an employee who’s eligible for sick pay due to coronavirus.

you have a PAYE payroll scheme that was created and started on or before 30 November 2021.

you had fewer than 250 employees on 30 November 2021 across all PAYE payroll schemes.

The maximum number of employees you can claim for is the number you had across your PAYE schemes on 30 November 2021.

You can use the scheme to claim back up to two weeks of statutory sick pay (SSP), at the relevant standard weekly rate of £96.35, for employees who were off work due to coronavirus on or after 21 December 2021.

Employees do not have to give you a doctor’s fit note for you to make a claim. But you can ask them to give you either:

an isolation note from NHS 111 – if they are self-isolating and cannot work because of coronavirus.

a ‘shielding note’ or a letter from their doctor or health authority advising them to shield because they’re at high risk of severe illness from coronavirus.

The scheme covers all types of employment contracts, including:

full-time employees

part-time employees

employees on agency contracts

employees on flexible or zero-hour contracts

fixed term contracts (until the date their contract ends)

How to claim through the Coronavirus Statutory Sick Pay Rebate Scheme

The online service to reclaim SSP is here.

To use the online service you will need the Government Gateway user ID you got when you registered for PAYE Online. If you did not register online you will need to enrol for the PAYE Online service.

You'll also need:

the number of employees you are claiming for.

start and end dates of your claim period.

the total amount of sick pay you’re claiming back – this should not exceed two weeks of the set SSP rate.

your employer PAYE reference number.

the contact name and phone number of someone we can contact if we have queries.

your UK bank or building society account details (only provide account details where a Bacs payment can be accepted) including bank or building society account number (and roll number if it has one), sort code, name on the account and the address linked to the account.

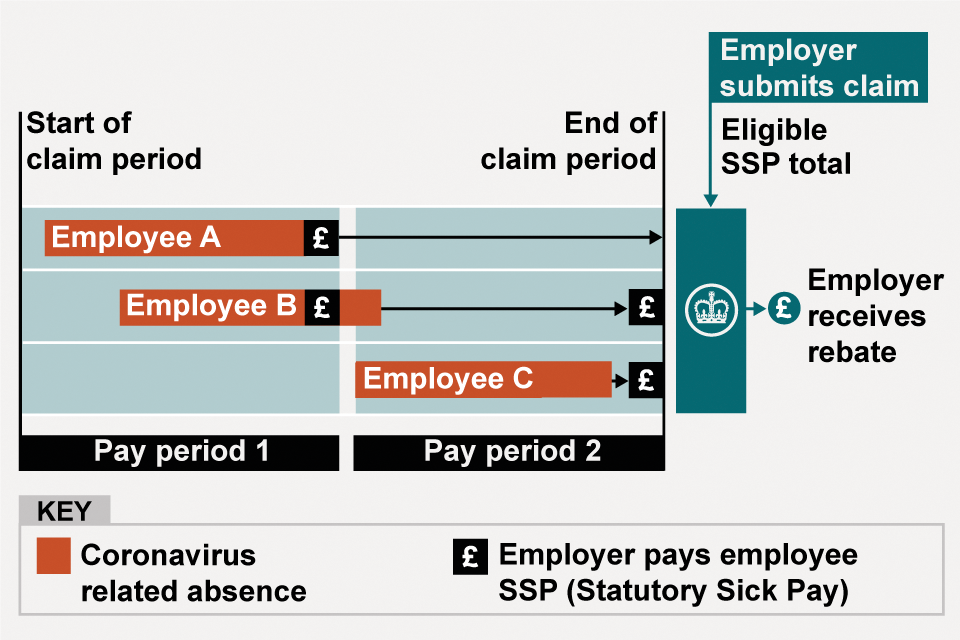

You can claim for multiple pay periods and employees at the same time. If you make multiple claims, the claim periods can overlap.

The maximum number of employees which you can claim for is the number you had across your PAYE schemes on 30 November 2021.

To complete your claim you’ll need the start and end dates of the claim period which is the:

start date of the earliest pay period you’re claiming for - if the pay period started before 21 December 2021 you’ll need to use 21 December 2021 as the start date.

end date of the most recent pay period you’re claiming for - this must be on or before the date you make your claim (because you can only claim for SSP paid in arrears).

Image showing an employer claiming SSP for three employees over two pay periods. The claim starts on the first day of the first pay period, and ends on the last day of the second pay period. The claim amount is what’s paid to each employee capped at two weeks.

Records you must keep

You must keep records of SSP that you've paid and want to claim back from HMRC.

You must keep the following records for three years after the date you receive the payment for your claim:

the dates the employee was off sick.

which of those dates were qualifying days.

the reason they said they were off work - if they had symptoms, someone they lived with had symptoms, someone they live with had symptoms or they were shielding.

the employee's National Insurance number.

You can choose how you keep records of your employees' sickness absence. HMRC may need to see these records if there's a dispute over payment of SSP.

You’ll need to print or save your state aid declaration (from your claim summary) and keep this until 31 December 2024.