The latest letter from the government sent to businesses with advice on how to prepare for a no deal Brexit

Posted: Thu 7th Feb 2019

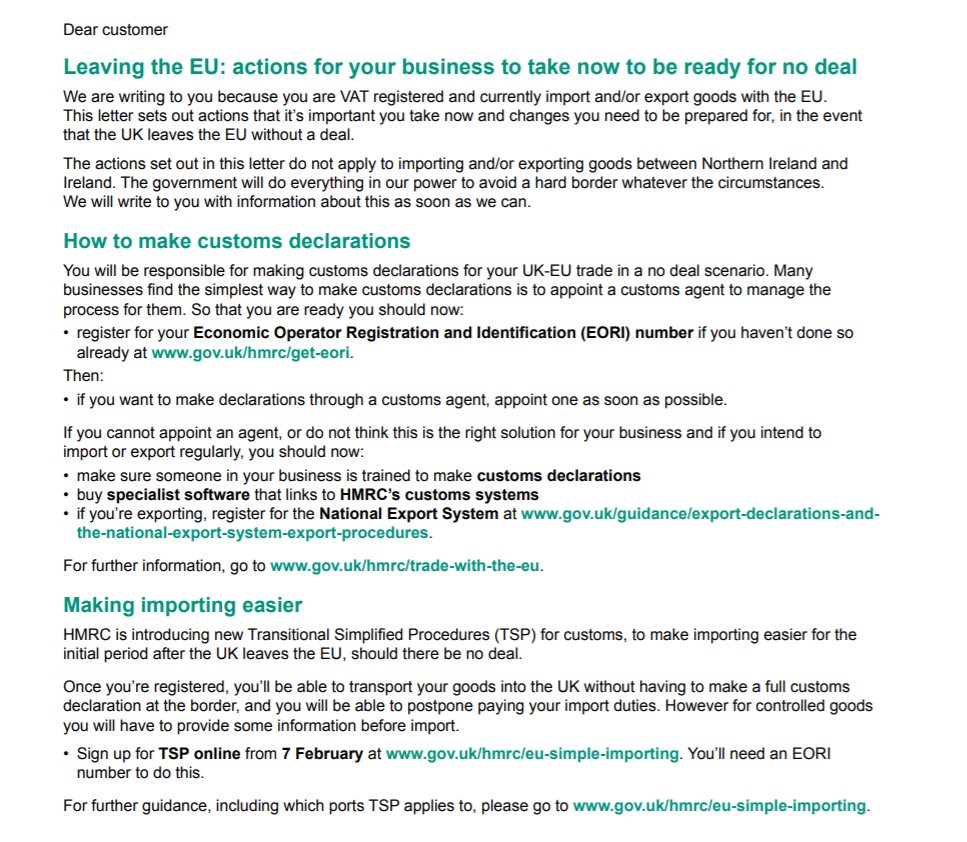

Around 145,000 VAT registered small businesses have today received a letter from the government with the latest advice on how to prepare if Britain leaves the European Union without a Brexit deal. The letter is below. Scroll to the end for a link to all the resources mentioned in the letter.

The letter announces the introduction of HM Revenue & Customs' (HMRC) new Transitional Simplified Procedures (TSP) for customs aimed at making importing easier in the event of no deal.

Once registered, businesses will be able to import goods into the UK without making a full customs declaration and payment of important duties can be postponed.

HMRC has said it expects TSP to remain in place for more than a year to give businesses time to prepare to use the full customs processes that already apply to imports from non-EU countries.

The policy will be reviewed three to six months after it's introduced on 29 March 2019 (the day Britain is due to leave the EU) to see how it's working.

The links mentioned in the letter:

Brexit Advice Service

Access content, events, advice and more to help you plan for the challenges and opportunities of Brexit with Enterprise Nation's Brexit Advice Service.